TD North Star Vision

What I did

Led the vision and design of a future-state advice experience, spanning customer booking flows, advisor tablet tools, and in-branch interactions. Built prototypes that told the story end-to-end and refined them through dozens of walkthroughs with stakeholders.

Why it matters

Redefined how financial advice could feel: more like a health check-up than a sales pitch. The work set a benchmark for personalization, inclusivity, and trust in a highly regulated industry.

Role

Innovation Design

Employer

TD Bank

Platforms

Figma Prototyping

Areas

Strategy, Design, Research

Setting the vision

The goal was never just to improve an interface, but to shift how financial advice feels — less like a sales pitch, more like a check-up. Working closely with my team of strategists and designers, I set out to define what a truly helpful, human experience could look like across the entire journey. We imagined a system where advisors come prepared with insight, not questions, and customers feel guided, not interrogated. That vision became our north star, shaping everything from inclusive booking flows to tailored in-meeting tools.

Helping users set the right context before the meeting even begins

Designing a flexible toolkit for better in-person conversations

Turning a great meeting into lasting momentum

Designing for real life

Designing for real life meant accounting for more than just ideal flows. We considered late arrivals, tech hiccups, accessibility needs, and emotional barriers. Every screen and surface was built with empathy, from giving users the option to pre-fill sensitive info before a meeting, to letting advisors present from a tablet instead of behind a desk. We even thought through ambient details like lighting preferences and scent-free rooms. By grounding the design in real-world contexts and constraints, we made the experience not just smarter, but more humane.

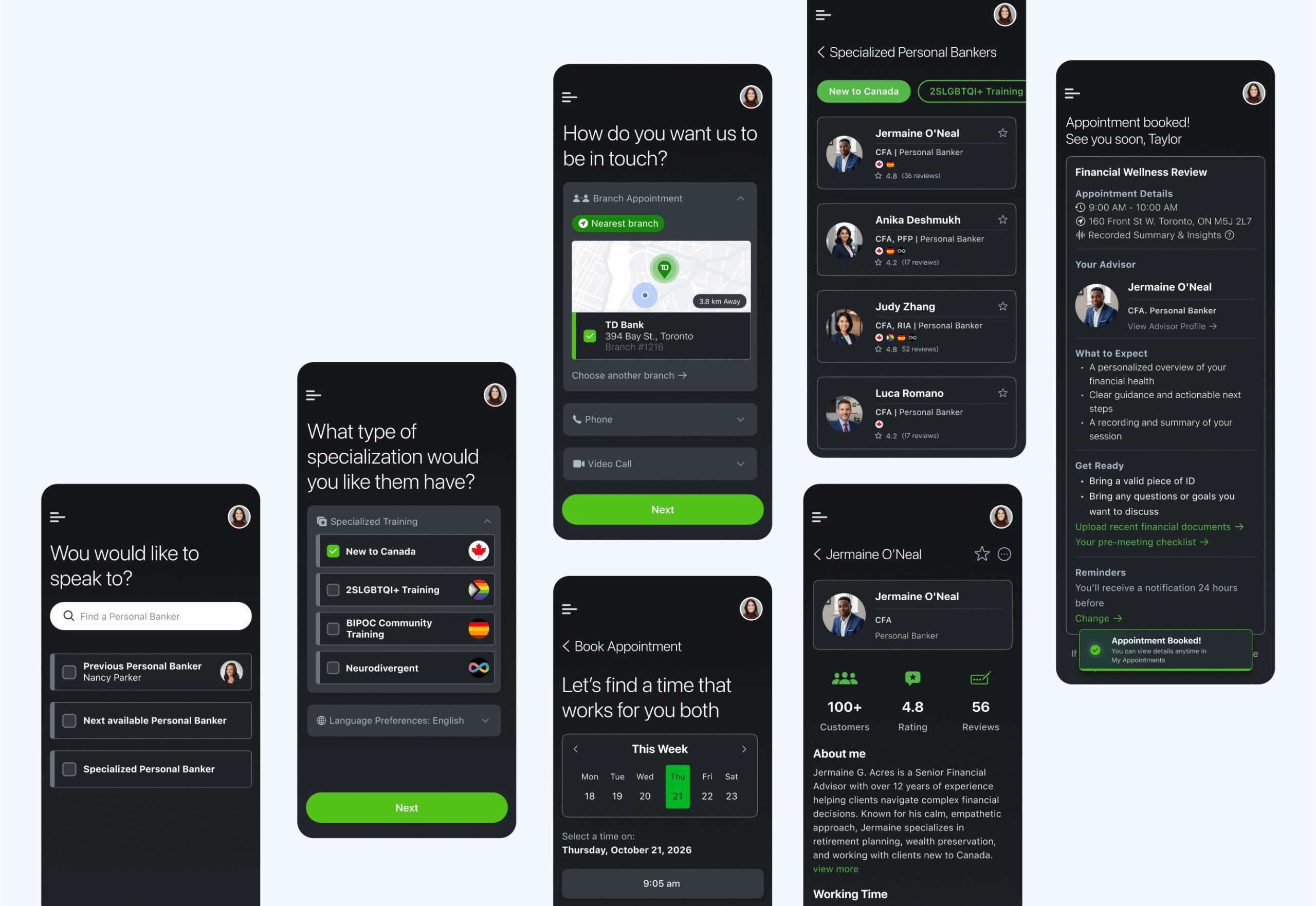

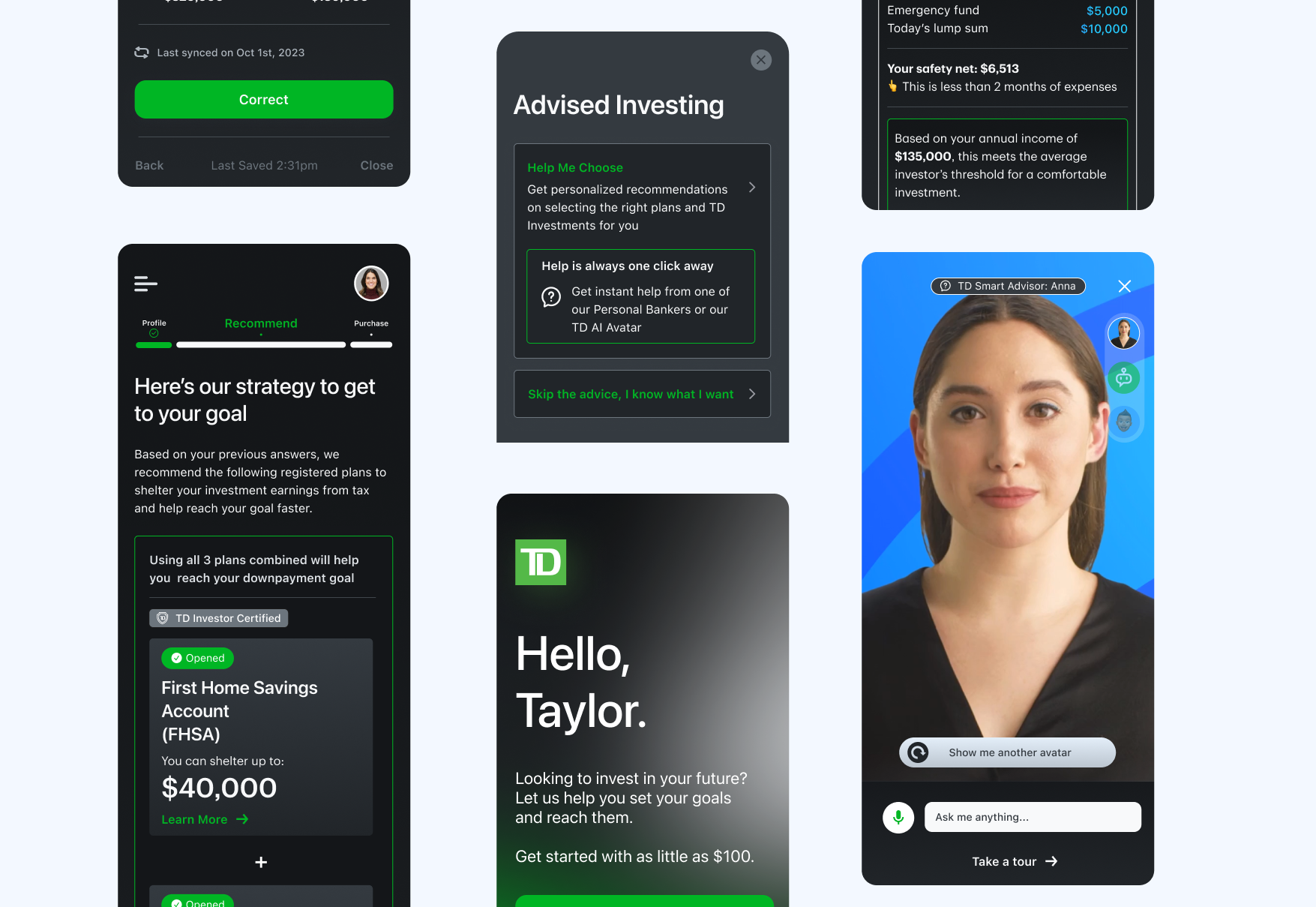

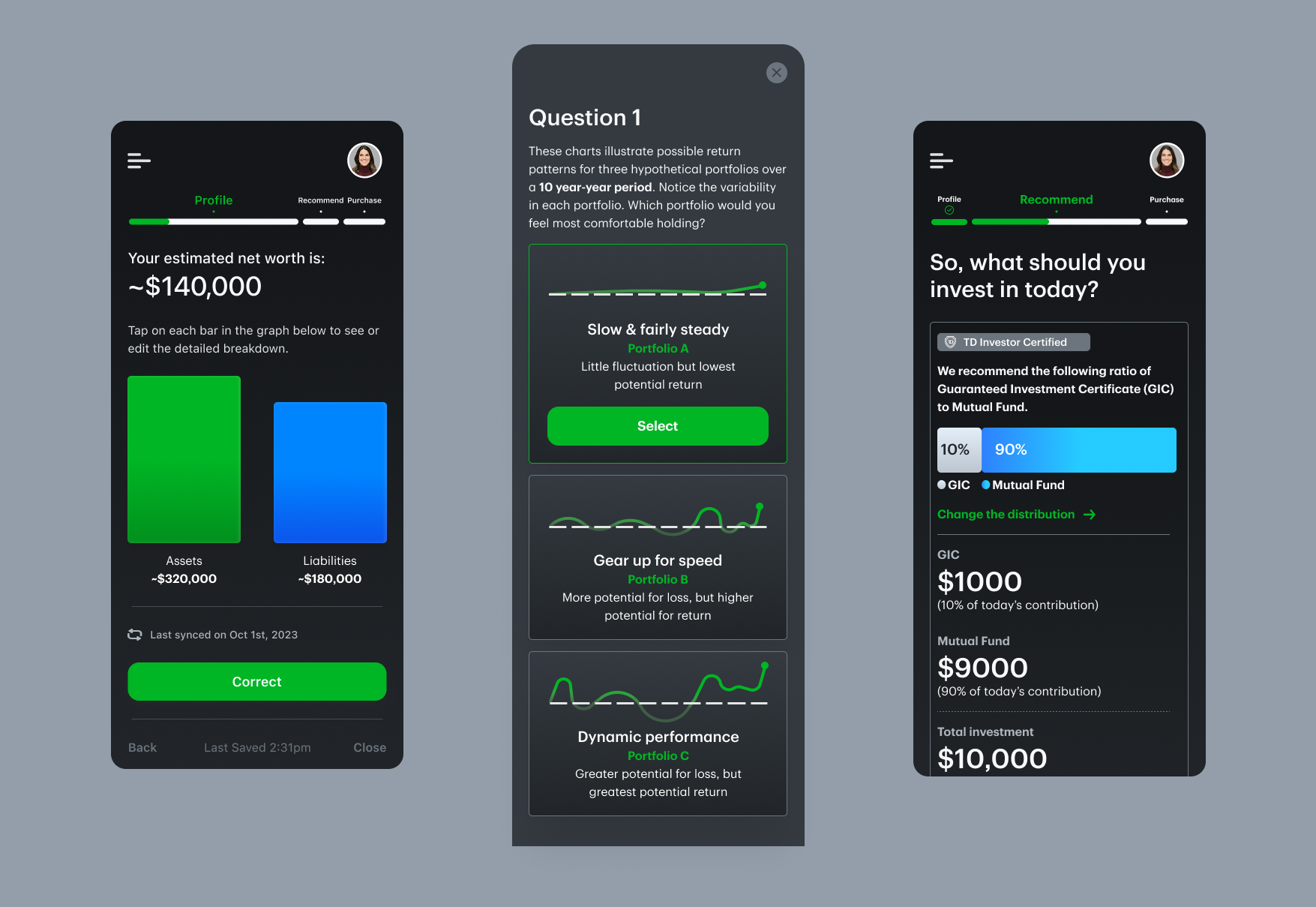

Mobile designs for the North Star Vision booking experience

Interactive prototype of the end-to-end booking journey in action

Smarter booking

The booking experience was redesigned to go beyond picking a date and time. We built a flow that asks the right questions up front, clear multiple choice and open-ended prompts that let users share their goals, preferences, and comfort levels. This allowed us to match customers with advisors whose expertise, communication style, and lived experience aligned with their needs. Instead of asking users to chase down the right fit, we brought personalization to them from the start, laying the groundwork for more meaningful conversations.

Interactive prototype of the advisor-facing tablet experience

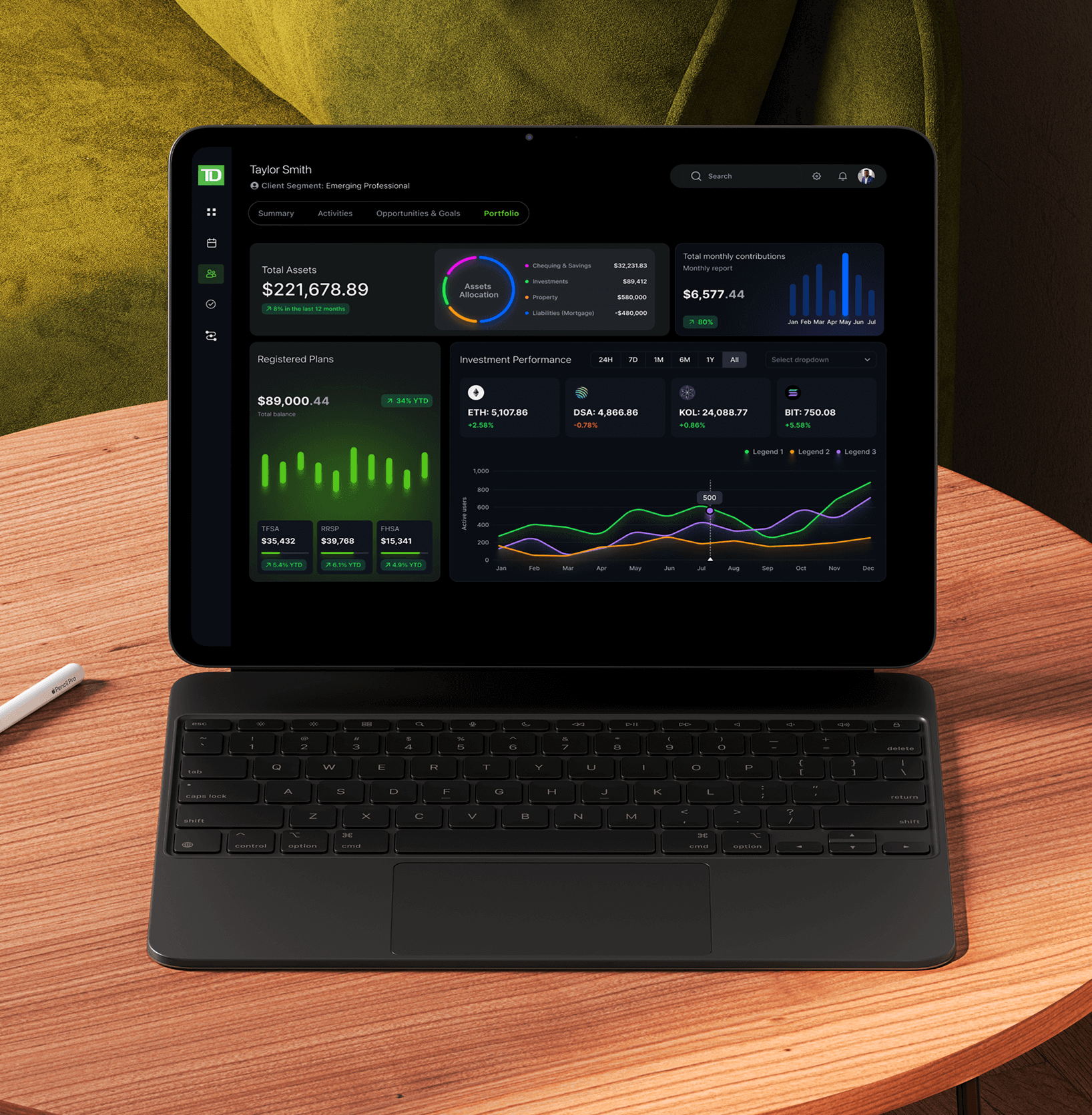

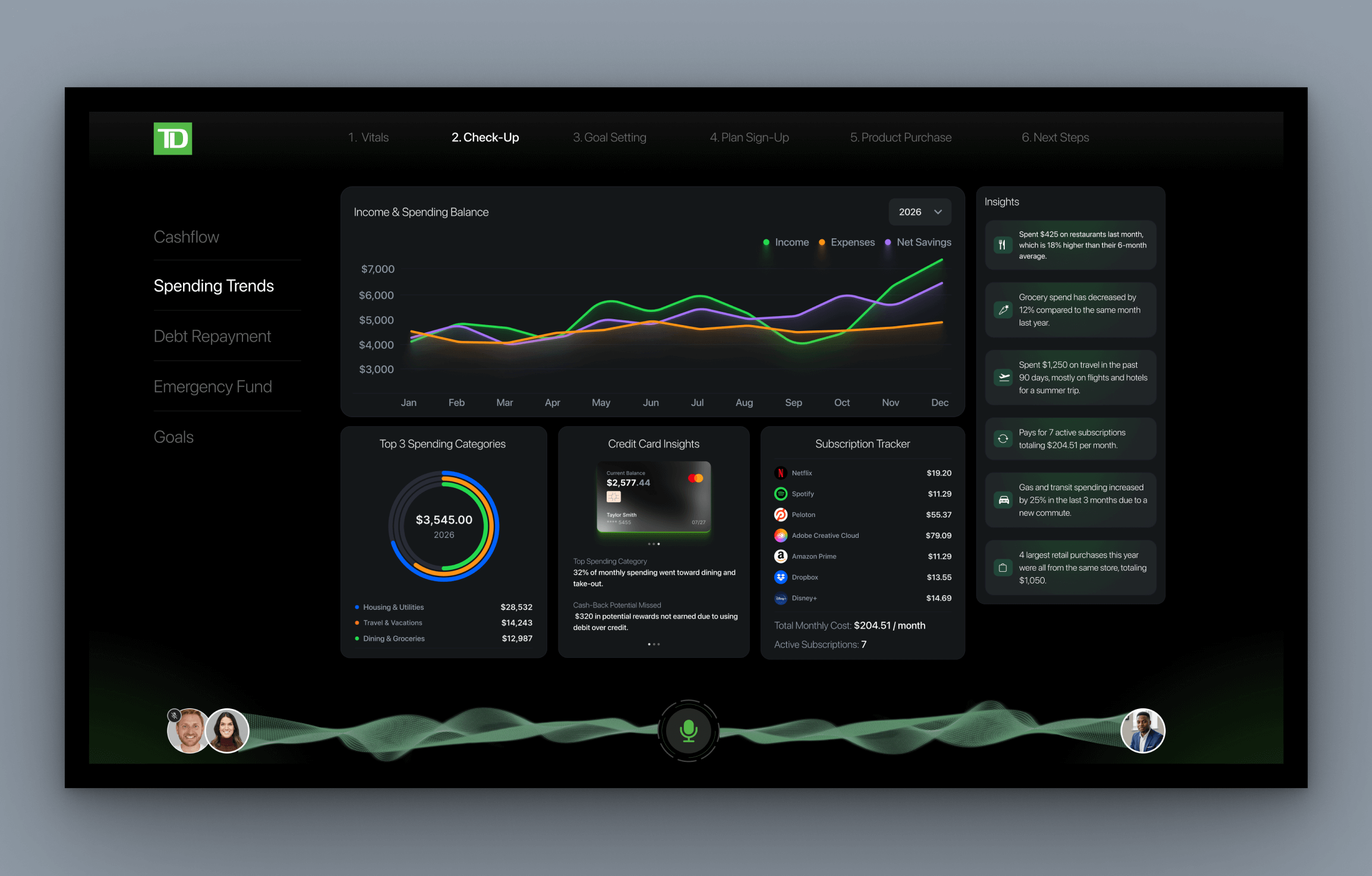

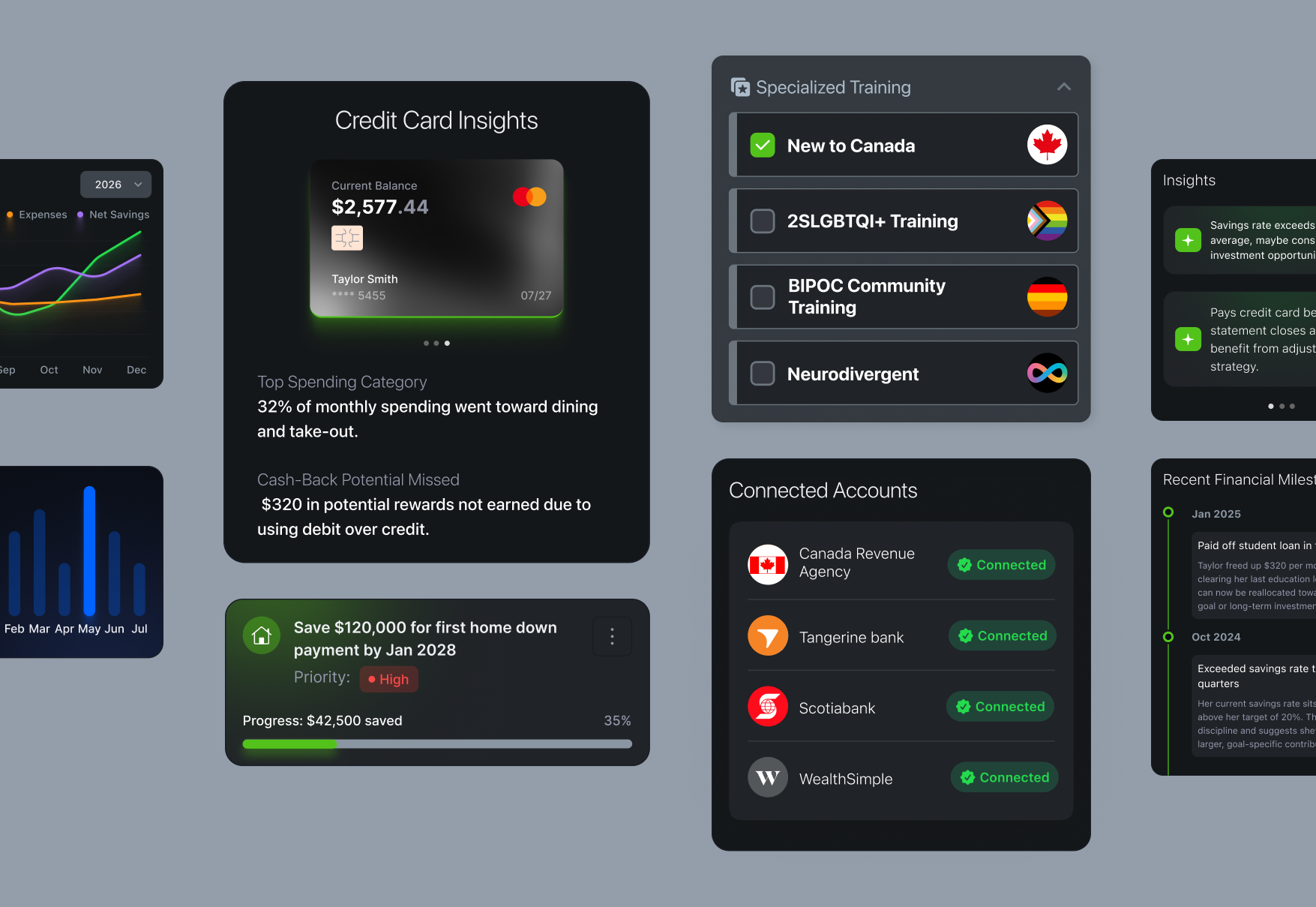

Advisor dashboard providing a holistic view of the customer’s financial health

Empowering Advisors

Advisors often juggle fragmented tools and siloed information, which makes it harder to focus on the person in front of them. We designed a flexible toolkit that brought everything into one place. A clear customer summary, holistic portfolio views, recent activities, spending insights, and even opportunities mapped directly to a client’s goals. Instead of digging through systems, advisors could spend their time listening, responding, and guiding. By giving them meaningful context at their fingertips, we made it easier to build trust and deliver advice that feels relevant and actionable.

In-meeting appointment screen designed to guide clients through their financial health with clarity and focus

The Appointment

A financial conversation can be intimidating, so we designed the in-meeting flow to feel more like a guided check-up than a sales session. Advisors could use their tablet to walk through visual dashboards, highlight spending insights, and surface milestones worth celebrating. Customers, in turn, saw their progress and goals reflected back in simple, digestible ways. Every screen was designed to make the exchange collaborative: something they worked through together, rather than a lecture from one side of the desk.

Seamless handoff from in-person advice to mobile follow-ups with AI support

Prototype showing how customers use built-in AI for deeper financial insights

The Follow-Through

The conversation didn’t end once the meeting wrapped up. Customers received a clear digital summary with key takeaways, agreed-upon next steps, and helpful resources tailored to their goals. This not only reinforced what was discussed but made it easier to share with family or revisit later. Advisors could also track follow-ups through their dashboard, making accountability part of the process. The result was a bridge between in-person advice and ongoing digital engagement and keeping momentum alive after the meeting.

Additionally, we designed pathways for customers to carry their momentum forward without needing to return to a branch. From the appointment summary, they could open accounts, adjust contributions, or explore recommended products directly within the app. If they wanted more support, re-booking their advisor was just a tap away. By connecting in-person advice with digital self-serve tools, we created a seamless loop where guidance and action worked hand in hand.

A Human-Centered Future

The North Star vision was never just about building screens. It was about rethinking the role advice plays in people’s financial lives, and how design can make that relationship feel more personal, supportive, and trustworthy. By grounding the work in empathy and designing for both sides of the conversation, we showed how financial advice could evolve into something more meaningful: a partnership built on understanding, clarity, and care.

© 2026 Eric Mok - Product Design Lead. All rights are reserved.